Hakim

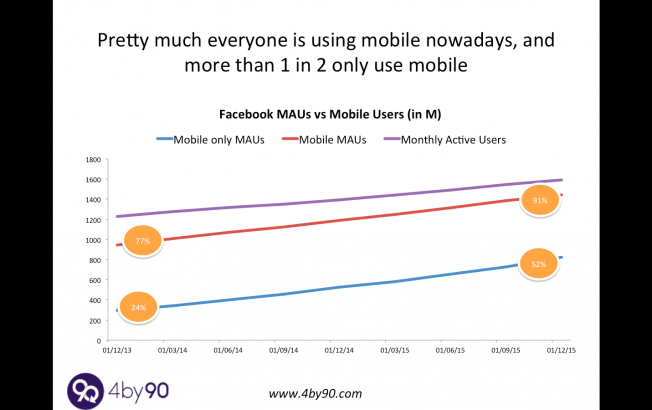

I thought I would share these 3 graphs to provide a better understanding as to how Facebook users have evolved in relation to the devices they use to access the service. It’s in reaction of a number of graphs that in my view albeit accurate gave the misleading impression that Facebook desktop users had disappeared. I believe this to be important as albeit mobile is crucially important, one shouldn’t neglect desktop as it remains a key part of most customers digital mix. Thoughts and comments are welcome. If you find this of interest please do like and share this post. These are based on Facebook official earning slides: http://investor.fb.com/results.cfm Here we go:

Part 2 – Why challenger banks need to be 100 times better than incumbents In my previous article I attempted to reframe the “Fintech debate” into one centred around its goal (competition) rather than its means (Innovation, Fintecth, etc.). In this piece I would like to offer a framework to discuss what an overall banking proposition is and why one will be better than another. This will lead me to argue that a challenger will have to be 100 times better than an incumbent to challenge at scale. What is a bank made of? First I would like to propose a simple model that will give us a framework to discuss the competitive advantages of different retail banking propositions. Let’s consider a retail bank to be made up of 4 core blocks: A block that makes it profitable and ensure it…

Forget about Fintechs and Innovation, they aren’t the point – Part 1: It’s all about competition This is the first instalment of a few articles to share my perspective on innovation, retail banking, Fintechs and competition. If you see some value in my perspective please do let me know. As they say on youtube “like it, share it, comment on it!” In this first piece I would like to challenge the usual narrative around Fintech discussions. I would like more focus on the end goal and whether it’s achieved (i.e. winning the competition war) rather than the means (Innovation, Fintech, etc). That will set the scene for my second piece around how we should evaluate emerging banking propositions. It’s a question of competition That’s a fairly simple point, but I think one that is far too often forgotten. All the discussions around…

What disruptive banking might really look like… So far, not much disruption… There is much talk about disruption and challenger banks. But there is currently little evidence of anything disruptive in the pipeline. Obviously, most haven’t even got their banking licenses yet and haven’t launched, hence it is hard to provide a final opinion on the matter. And by its very nature disruption tends to take industries by surprise. But judging challenger banks by what they promise to offer and solely on publicly available information, none bar one, promises anything that qualifies as being disruptive proposition-wise. None seem to plan to offer anything truly different from what existing banks provide. For most, based on their current PR, positioning and promises, they sound very similar to what established banks are doing or are in the process of doing. Why does being disruptive matter for challenger banks?…

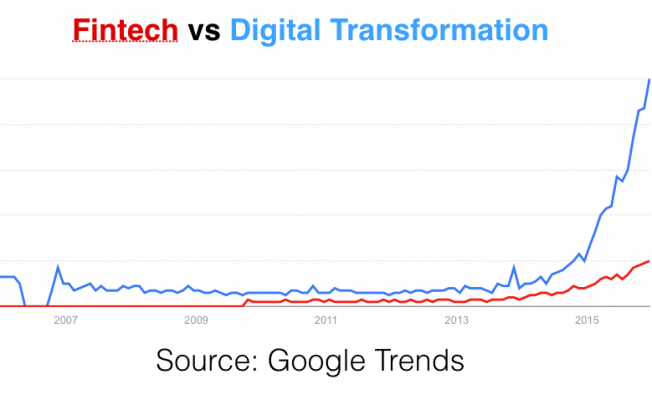

The rise of Fintechs (true) and some nonsensical conclusions you can reuse in presentations… I would like to share with you the conclusions of some (not) in depth analysis I have conducted, all supported by graphs (i.e. it must be true). 2015, the Fintech year? The above graph shows the rise in searches on google involving the word “Fintech”. That’s a truly remarkable graph, illustrating the increase in interest for Fintechs during the course of 2015, the word itself appearing as early as 2006. It will be interesting to see the trend in 2016. Verdict: conclusive Will digital transformation of big banks manage to fend off the threat of disruption? Yes! It seems that in 2015, according to google searches, Digital transformation has succeeded in fighting off disruption. Maybe not.. Apologies, actually it seems that even with the numerous digital…

Encounter of the third kind? Last week, on my way through security on a flight to Lisbon, I came across this unexpected, ghost- like figure (see the picture illustrating this post). Towering over a nondescript desk-like structure which she seemed stuck to. With a Colgate-like smile permanently stuck to her face, she was cheerfully reminding anyone bothered to pay any attention of the basic rules pertaining to liquid allowance and transparent bags. It was an unexpected sight in the not too futuristic setting of Luton airport. It did feel like a vision of the future. How could a fairly standard video of a person displayed on a screen feel like such a futuristic sight? Why was that? Thinking, Fast and Slow. When design fools our senses.. I think this was achieved through the simple means of the screen having the shape of…